Indices CFDs

Trading

Indices CFDs (Contracts for Difference) offer traders the opportunity to speculate on the performance of a stock market index without needing to buy or sell the underlying stocks. Indices represent a collection of stocks from a specific market or sector, and trading indices CFDs allows you to profit from movements in the overall market or specific sectors.

INDICES

What are Indices CFDs?

Indices CFDs are financial derivatives that allow traders to speculate on the price movements of stock market indices. When trading an index CFD, you enter into a contract with a broker to exchange the difference in the index’s price from the time the contract is opened to when it is closed. If the index rises and you have taken a long (buy) position, you make a profit; if it falls and you have taken a short (sell) position, you benefit from the decline.

Benefits of

Indices

Trading

Diversification

Trading indices CFDs allows you to gain exposure to a broad range of stocks within an index, providing diversification and reducing the risk associated with individual stock investments.

Leverage

CFDs offer the ability to control a larger position with a smaller amount of capital. This can amplify potential returns, but also increases the risk of significant losses.

Access to Major Markets

Indices CFDs cover a range of major global markets, such as the S&P 500, FTSE100, DAX 30, and Nikkei 225, enabling traders to tap into different economic regions and sectors.

No Need for Physical Shares

When trading index CFDs, you don’t need to buy or sell the underlying shares of the companies within the index, simplifying the trading process.

Flexible Trading Opportunities

Traders can take both long (buy) and short (sell) positions, allowing them to profit from both rising and falling markets.

Trade different with

Amillex

Tight and competitive spreads

World class of tight and competitive spreads across full range of products

Ultra-fast execution speed

We consistently strive to achieve swift execution speeds for all products within our range.

Flexible leverage

Trade with leverage up to 500:1, allowing for increased position size relative to the trading capital.

Amillex Products

Indices Market Spreads, Commissions and

Swaps

The Spreads, Swap Rates and Commissions columns are indicative only. The currency for swaps and commissions is based on your account currency.

| Symbol | Digits | Currency | Average Spread | Contract Size | SWAP Long | SWAP Short | Fixed Leverage | |

| AUS200 | Australia 200 | 2 | AUD | 250 | 10 | -230.836 | -1299.75 | 100 |

| CA60 | Canada 60 | 2 | CAD | 90 | 100 | -40.5646 | -104.92 | 100 |

| CN50 | China A50 | 2 | USD | 700 | 10 | -17.2185 | -20.1556 | 100 |

| ES35 | Spain 35 | 2 | EUR | 580 | 10 | -304.086 | -5619.66 | 100 |

| EU50 | Euro 50 | 2 | EUR | 200 | 10 | -122.016 | -1373.38 | 100 |

| FRA40 | France 40 | 2 | EUR | 250 | 10 | -218.253 | -2469.24 | 100 |

| GER40 | Germany 40 | 2 | EUR | 450 | 10 | -498.203 | -138.307 | 100 |

| HK50 | Hong Kong 50 | 2 | HKD | 400 | 100 | -494.704 | -749.384 | 100 |

| HSCH | Hong Kong China H-Shares | 2 | HKD | 1000 | 100 | -175.418 | -395.534 | 100 |

| JP225 | Japan 225 | 2 | JPY | 780 | 1000 | -434.666 | -414.225 | 100 |

| NAS100 | US Nasdaq 100 | 2 | USD | 200 | 10 | -527.746 | 0.2075 | 100 |

| NETH25 | Netherlands 25 | 2 | EUR | 40 | 100 | -22.2898 | -273.18 | 100 |

| NOR25 | Norway 25 | 2 | NOK | 90 | 1000 | -39.3585 | -9.8828 | 100 |

| SP500 | US SP 500 | 2 | USD | 130 | 10 | -151.761 | 0.2075 | 100 |

| UK100 | UK 100 | 2 | GBP | 290 | 10 | -268.952 | -2075.25 | 100 |

| US30 | US Dow Jones 30 | 2 | USD | 310 | 10 | -1145.966 | 0.2075 | 100 |

| USD_Index_Forward | US Dollar Index Forward | 2 | USD | 5 | 1000 | N/A | N/A | 100 |

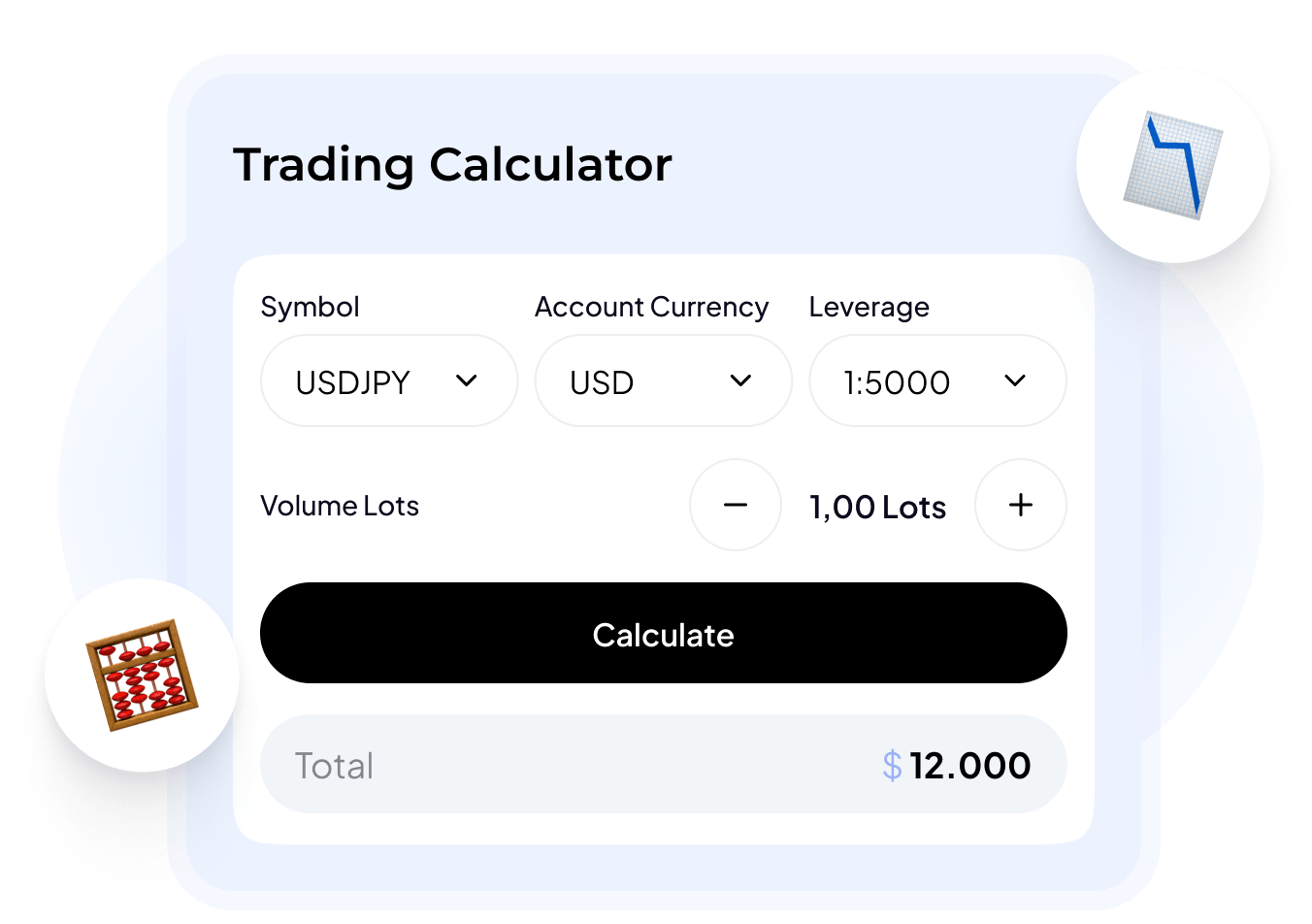

TRADING CALCULATOR

Trading Calculator

Simplify your trading with the Amillex Investment Calculator! Instantly calculate pips, margin, spread, commission, swap, and more—all in one easy-to-use tool. Take the guesswork out of complex trading calculations and focus on what truly matters: maximizing your strategy. Trade smarter. Trade different with Amillex!