Precious Metals

Trading

Precious metals, including gold, silver, platinum, and palladium, have long been valued for their intrinsic qualities and financial stability. These metals are crucial for various industries, such as manufacturing and technology, and are often considered safe-haven assets during times of economic uncertainty. Trading precious metals through Contracts for Difference (CFDs) offers a flexible and accessible way to speculate on their price movements without the need to own the physical assets.

METALS

What Are Precious Metals CFDs?

Contracts for Difference (CFDs) are financial derivatives that allow traders to speculate on the price movements of underlying assets, such as precious metals. When you trade a CFD on a precious metal, you enter into a contract with a broker to exchange the difference in the price of the metal from when the contract is opened to when it is closed. If the price moves in your favor, you earn a profit; if it moves against you, you incur a loss.

Benefits of

Trading

Precious

Metals

CFDs

Leverage

CFDs offer the ability to control a larger position with a relatively small amount of capital, which can amplify potential returns. However, leverage also increases risk, so it should be used with caution.

Flexibility

Traders can take both long (buy) and short (sell) positions, allowing them to profit from both rising and falling markets.

Diverse Market Access

Precious metals CFDs provide access to a range of metals, including gold, silver, platinum, and palladium, each with its own market dynamics.

No Physical Handling

Trading CFDs means you do not need to physically store or transport the metals, simplifying the trading process.

Safe-Haven Asset Exposure

Precious metals, particularly gold, are often seen as safe-haven assets, which can be advantageous during periods of market volatility and economic instability.

Trade Different With

Amillex

Tight and competitive spreads

World class of tight and competitive spreads across full range of products

Ultra-fast execution speed

We consistently strive to achieve swift execution speeds for all products within our range.

Flexible leverage

Trade with leverage up to 500:1, allowing for increased position size relative to the trading capital.

Amillex Products

Forex Market Spreads, Commissions And

Swaps

The Spreads, Swap Rates and Commissions columns are indicative only. The currency for swaps and commissions is based on your account currency.

| Symbol | Digits | Avg.spread | Commission | Contract Size | Long swap | Short swap | Max Leverage | |

| Major Metals | ||||||||

| XAUUSD | Gold | 2 | 23 | 0 | 100 | -51.204 | 18.9942 | 500 |

| XAGUSD | Silver | 3 | 13 | 0 | 5000 | -7.13824 | 0.23424 | 250 |

| Minor Metals | ||||||||

| XCUUSD | Copper | 2 | 750 | 0 | 10 | -234.636 | 0.32544 | 50 |

| XPDUSD | Palladium | 2 | 210 | 0 | 100 | -24.84832 | 0.88548 | 50 |

| XPTUSD | Platinum | 2 | 90 | 0 | 100 | -24.8448 | -1.2388 | 50 |

| XAUAUD | Gold vs AUD | 2 | 68 | 0 | 100 | -67.656 | 2.03568 | 50 |

| Symbol | Digits | Avg.spread | Commission | Contract Size | Long swap | Short swap | Max Leverage | |

| Major Metals | ||||||||

| XAUUSD | Gold | 2 | 18 | 0 | 100 | -51.204 | 18.9942 | 250 |

| XAGUSD | Silver | 3 | 12 | 0 | 5000 | -7.13824 | 0.23424 | 250 |

| Minor Metals | ||||||||

| XCUUSD | Copper | 2 | 750 | 0 | 10 | -234.636 | 0.32544 | 50 |

| XPDUSD | Palladium | 2 | 210 | 0 | 100 | -24.84832 | 0.88548 | 50 |

| XPTUSD | Platinum | 2 | 90 | 0 | 100 | -24.8448 | -1.2388 | 50 |

| XAUAUD | Gold vs AUD | 2 | 68 | 0 | 100 | -67.656 | 2.03568 | 50 |

| Symbol | Digits | Avg.spread | Commission | Contract Size | Long swap | Short swap | Max Leverage | |

| Major Metals | ||||||||

| XAUUSD | Gold | 2 | 8 | 7 | 100 | -51.204 | 18.9942 | 250 |

| XAGUSD | Silver | 3 | 10 | 7 | 5000 | -7.13824 | 0.23424 | 250 |

| Minor Metals | ||||||||

| XCUUSD | Copper | 2 | 750 | 0 | 10 | -234.636 | 0.32544 | 50 |

| XPDUSD | Palladium | 2 | 210 | 0 | 100 | -24.84832 | 0.88548 | 50 |

| XPTUSD | Platinum | 2 | 90 | 0 | 100 | -24.8448 | -1.2388 | 50 |

| XAUAUD | Gold vs AUD | 2 | 68 | 0 | 100 | -67.656 | 2.03568 | 50 |

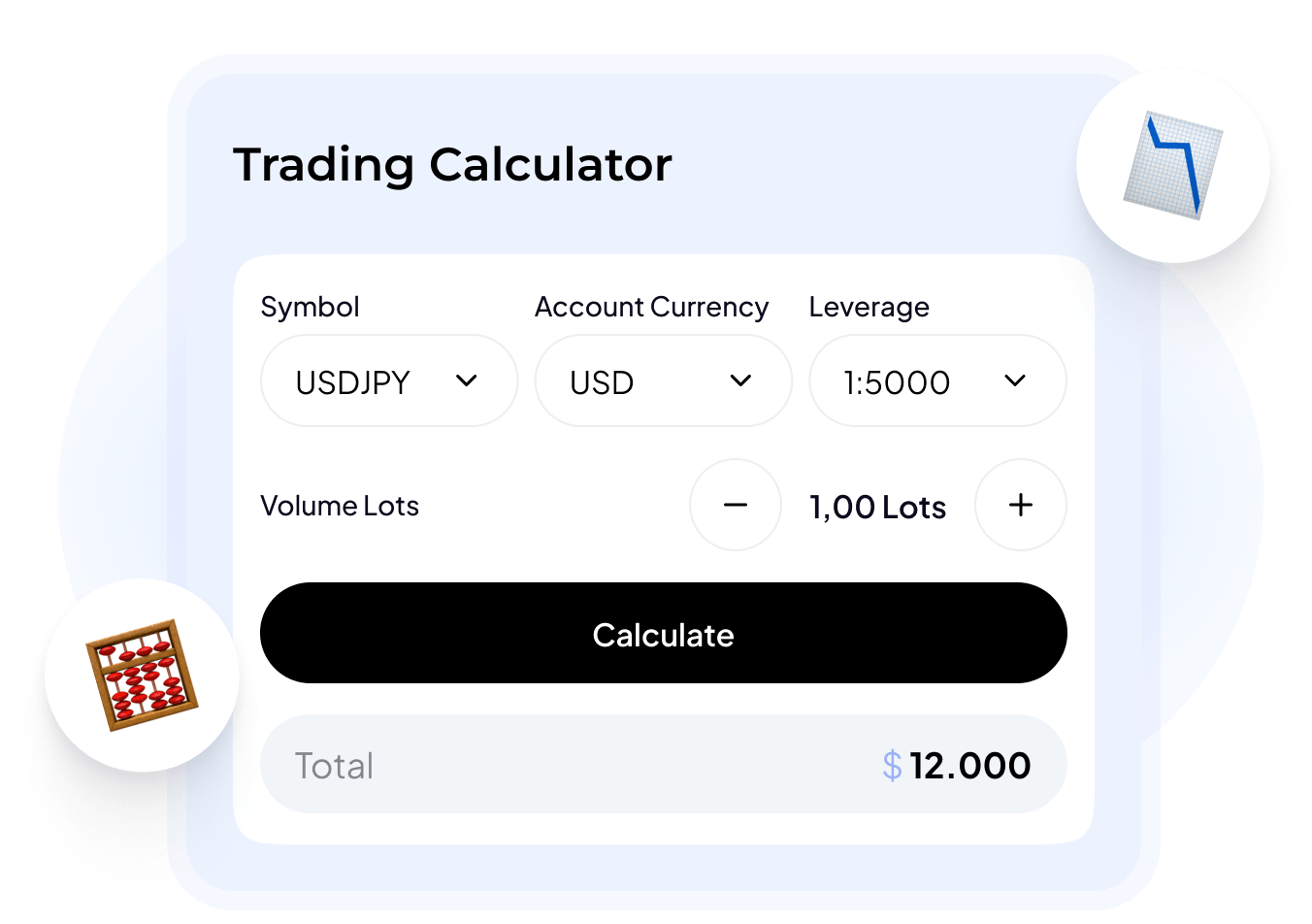

TRADING CALCULATOR

Trading Calculator

Simplify your trading with the Amillex Investment Calculator! Instantly calculate pips, margin, spread, commission, swap, and more—all in one easy-to-use tool. Take the guesswork out of complex trading calculations and focus on what truly matters: maximizing your strategy. Trade smarter. Trade different with Amillex!

Frequently Asked Questions

How Does Dynamic Leverage Work?

Dynamic Leverage adjusts the leverage on individual symbols based on open position volume, helping to manage risk as positions grow. Here’s how it works for different asset categories:

Metals (Major Metals)

For major metals, the leverage for each new position on each symbol decreases as the existing open position volume increases:

- 0 – 5 Lots: Maximum leverage of 1:500

- 5 – 10 Lots: Maximum leverage of 1:250

- 10 – 20 Lots: Maximum leverage of 1:100

- 20 – 50 Lots: Maximum leverage of 1:10

- 50 Lots or more: Maximum leverage of 1:5

Forex (Major/Minor FX)

For major and minor Forex pairs, the leverage for each new position on each symbol decreases as the existing open position volume increases:

- 0 – 20 Lots: Maximum leverage of 1:500

- 20 – 50 Lots: Maximum leverage of 1:250

- 50 – 100 Lots: Maximum leverage of 1:100

- 100 Lots or more: Maximum leverage of 1:10

By progressively lowering leverage as open position volume increases, Dynamic Leverage helps manage the risks associated with larger positions, providing more stability and mitigating potential large losses in highly leveraged accounts.