貴金屬

貿易

貴金屬,包括金、銀、鉑和鈀,長期以來因其內在品質和金融穩定性而受到重視。這些金屬對於製造業和技術等各個行業至關重要,並且在經濟不確定時期通常被視為避險資產。透過差價合約(CFD)交易貴金屬提供了一種靈活且方便的方式來推測其價格變動,而無需擁有實體資產。

金屬

什麼是貴金屬差價合約?

差價合約 (CFD) 是金融衍生品,允許交易者推測貴金屬等標的資產的價格變動。當您交易貴金屬差價合約時,您與經紀商簽訂合約,以交換合約開倉至平倉期間金屬價格的差額。如果價格變動對您有利,您就賺取利潤;如果走勢對你不利,你就會遭受損失。

的好處

貿易

寶貴的

金屬

差價合約

槓桿作用

差價合約能夠以相對較少的資金控制較大的頭寸,從而放大潛在回報。但槓桿也會增加風險,因此應謹慎使用。

靈活性

交易者可以同時持有多頭(買入)和空頭(賣出)頭寸,使他們能夠從上漲和下跌的市場中獲利。

多元化的市場准入

貴金屬差價合約提供了一系列金屬的交易機會,包括黃金、白銀、鉑金和鈀金,每種金屬都有自己的市場動態。

無物理處理

交易差價合約意味著您無需實際存放或運輸金屬,從而簡化了交易流程。

避險資產敞口

貴金屬,尤其是黃金,通常被視為避險資產,在市場波動和經濟不穩定時期可能具有優勢。

貿易不同

阿米萊克斯

緊密且具競爭力的點差

全系列產品均具有世界級的緊密且具競爭力的點差

超快的執行速度

我們始終致力於為我們範圍內的所有產品實現快速的執行速度。

槓桿靈活

交易槓桿高達 500:1,允許相對於交易資本增加部位規模。

Amillex 產品

外匯市場點差、佣金和

掉期

點差、掉期利率及佣金欄僅供參考。掉期和佣金的貨幣是基於您的帳戶貨幣。

| 象徵 | 數位 | 平均價差 | 委員會 | 合約規模 | 長互換 | 空頭掉期 | 最大槓桿 | |

| 主要金屬 | ||||||||

| 黃金美元 | 金子 | 2 | 23 | 0 | 100 | -51.204 | 18.9942 | 500 |

| 極飛美元 | 銀 | 3 | 13 | 0 | 5000 | -7.13824 | 0.23424 | 250 |

| 小金屬 | ||||||||

| XCU美元 | 銅 | 2 | 750 | 0 | 10 | -234.636 | 0.32544 | 50 |

| XPD美元 | 鈀 | 2 | 210 | 0 | 100 | -24.84832 | 0.88548 | 50 |

| XPT美元 | 鉑 | 2 | 90 | 0 | 100 | -24.8448 | -1.2388 | 50 |

| XAUAUD | 黃金兌澳元 | 2 | 68 | 0 | 100 | -67.656 | 2.03568 | 50 |

| 象徵 | 數位 | 平均價差 | 委員會 | 合約規模 | 長互換 | 空頭掉期 | 最大槓桿 | |

| 主要金屬 | ||||||||

| 黃金美元 | 金子 | 2 | 18 | 0 | 100 | -51.204 | 18.9942 | 250 |

| 極飛美元 | 銀 | 3 | 12 | 0 | 5000 | -7.13824 | 0.23424 | 250 |

| 小金屬 | ||||||||

| XCU美元 | 銅 | 2 | 750 | 0 | 10 | -234.636 | 0.32544 | 50 |

| XPD美元 | 鈀 | 2 | 210 | 0 | 100 | -24.84832 | 0.88548 | 50 |

| XPT美元 | 鉑 | 2 | 90 | 0 | 100 | -24.8448 | -1.2388 | 50 |

| XAUAUD | 黃金兌澳元 | 2 | 68 | 0 | 100 | -67.656 | 2.03568 | 50 |

| 象徵 | 數位 | 平均價差 | 委員會 | 合約規模 | 長互換 | 空頭掉期 | 最大槓桿 | |

| 主要金屬 | ||||||||

| 黃金美元 | 金子 | 2 | 8 | 7 | 100 | -51.204 | 18.9942 | 250 |

| 極飛美元 | 銀 | 3 | 10 | 7 | 5000 | -7.13824 | 0.23424 | 250 |

| 小金屬 | ||||||||

| XCU美元 | 銅 | 2 | 750 | 0 | 10 | -234.636 | 0.32544 | 50 |

| XPD美元 | 鈀 | 2 | 210 | 0 | 100 | -24.84832 | 0.88548 | 50 |

| XPT美元 | 鉑 | 2 | 90 | 0 | 100 | -24.8448 | -1.2388 | 50 |

| XAUAUD | 黃金兌澳元 | 2 | 68 | 0 | 100 | -67.656 | 2.03568 | 50 |

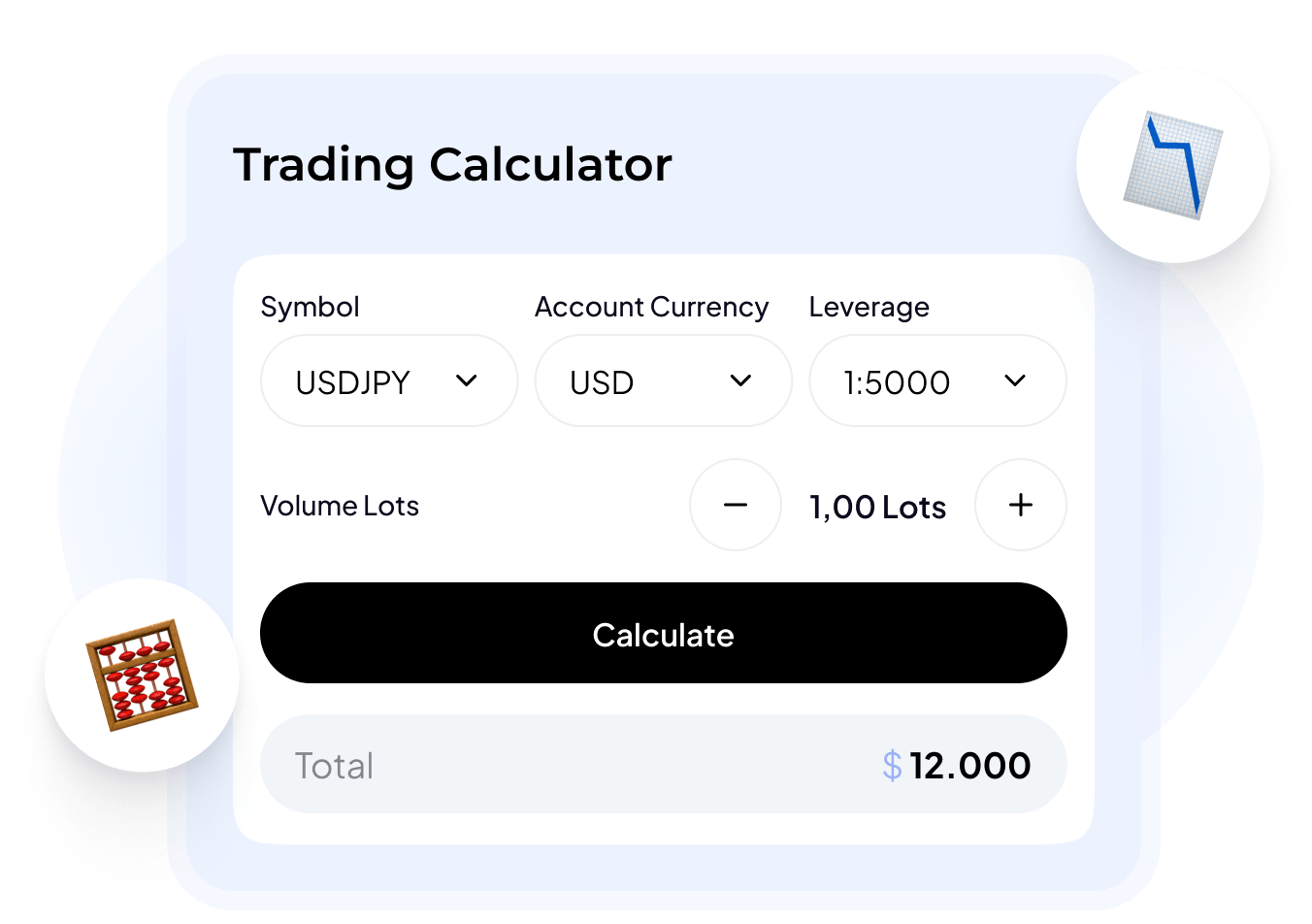

交易計算器

交易計算器

使用 Amillex 投資計算器簡化您的交易!即時計算點值、保證金、點差、佣金、隔夜利息等——所有這些都在一個易於使用的工具中。消除複雜交易計算中的猜測,專注於真正重要的事情:最大化您的策略。交易更明智。與 Amillex 進行不同的交易!

常見問題解答

動態槓桿如何運作?

動態槓桿根據未平倉部位數量調整各個交易品種的槓桿,有助於在部位成長時管理風險。以下是它針對不同資產類別的工作原理:

金屬(主要金屬)

對於主要金屬,隨著現有未平倉部位數量的增加,每個交易品種的每個新部位的槓桿率都會降低:

- 0 – 5 批:最大槓桿為1:500

- 5 – 10 批:最大槓桿為1:250

- 10 – 20 批:最大槓桿為1:100

- 20 – 50 批:最大槓桿為1:10

- 50 手或以上:最大槓桿為1:5

外匯(主要/次要外匯)

對於主要和次要外匯對,隨著現有未平倉部位數量的增加,每個交易品種上每個新部位的槓桿率都會降低:

- 0 – 20 手:最大槓桿為1:500

- 20 – 50 批:最大槓桿為1:250

- 50 – 100 手:最大槓桿為1:100

- 100 手或以上:最大槓桿為1:10

透過隨著未平倉頭寸數量的增加逐步降低槓桿,動態槓桿有助於管理與較大頭寸相關的風險,提供更高的穩定性並減輕高槓桿帳戶中潛在的巨額損失。